Tag: Gold Price

-

Growing lineups mix with affordability challenges as Winnipeg retailers navigate surge in gold prices

Market trends: a city watching gold prices Winnipeg is experiencing a notable shift as the price of gold continues its steady ascent. Local jewelers, pawn shops, and coin dealers report longer lines and increased activity from customers looking to sell or invest in gold. The surge in gold prices is not just a headline; it’s…

-

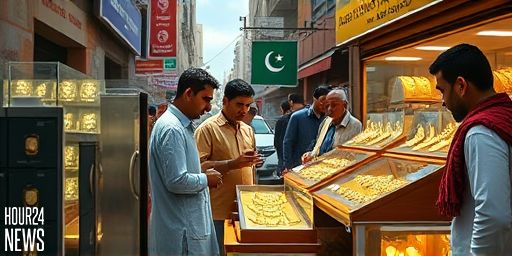

Gold Prices in Pakistan Today: Fresh Records as Bullion Rally Continues

Gold Prices in Pakistan Today Gold prices in Pakistan today reflect a powerful global rally in bullion markets, underscoring the close link between international trends and domestic rates. As investors worldwide seek a safe haven amid economic uncertainty and inflationary pressures, Pakistan’s local gold market has followed suit, pushing local rates to new highs. The…

-

Gold Price Forecast: XAU/USD Faces Resistance Near $4,445

Gold Price Forecast: What’s Driving the Move Gold is back in focus for traders as geopolitical tensions intensify after the weekend U.S. intervention in Venezuela. The precious metal has rebounded sharply, with XAU/USD up nearly 2.4% on the day and trading around the $4,435 area. Market participants are eyeing the next key levels as risk…

-

Gold Surges Above 4350 as Geopolitics Roil Markets in Asia

Gold Reaches Multi-Week High on Geopolitical Fears Gold prices climbed above the key $4,350 level in early Asia trading on Monday, signaling renewed investor demand for the precious metal as geopolitical tensions persist. The dollar-denominated spot price for gold (XAU/USD) moved toward $4,370, extending its upside as risk sentiment remained fragile in the wake of…

-

Gold Price Surges Above $4,350 As Geopolitical Tensions Fuel Demand

Gold Price Climbs as Geopolitical Tensions Escalate Gold prices jumped above the $4,350 level in early trading on Monday, with XAU/USD trading around $4,370 as traders digested fresh geopolitical headwinds. The precious metal has found renewed demand as investors seek shelter amid rising uncertainty in global affairs. Specifically, sentiment has shifted in response to the…

-

Gold Forecast 2026: Macro Forces and Breakouts Point to $6,000

Executive Summary: A Bold Gold Outlook for 2026 Gold investors are weighing a compelling mix of macro dynamics and technical signals as we approach the mid-2020s. The combination of monetary policy shifts, renewed liquidity in the system, and a series of price breakouts across multiple timeframes has traders eyeing a potential move toward $6,000 per…

-

Gold Forecast 2026: Macro Forces and Technical Breakouts Point to $6,000

Overview: Why 2026 Could Be a Pivotal Year for Gold Gold investors are increasingly focused on a single question: can prices reach $6,000 by 2026? The answer hinges on a mix of macroeconomic forces, central bank liquidity, inflation dynamics, and technical breakout patterns that are flashing a potentially powerful long-term signal. While traders watch near-term…

-

Gold Forecast 2026: Macro Forces and Technical Breakouts Signal a Path to $6,000

Overview: Why 2026 Could Be a Breakout Year for Gold Gold investors are eyeing a potential surge that could push prices toward $6,000 by 2026. While headlines often focus on inflation or recession fears, the most compelling case for a multi-thousand-dollar move rests on a combination of macro forces and technical breakouts that reinforce each…