Tag: gas prices

-

Global LNG Wave to Accelerate Natural Gas Demand in 2026, Says IEA

IEA Reports Faster Gas Demand Growth Fueled by LNG Wave in 2026 The IEA’s latest quarterly Gas Market Report highlights a pivotal shift for global energy markets as 2026 shapes up to be a turning point for natural gas. After a year of softer growth, demand for natural gas, particularly in the form of liquefied…

-

U.S. Natural Gas Prices Surge 45% as Arctic Cold Sends Gas Markets Rally

Arctic Cold Sparks a Sharp Rally in U.S. Natural Gas U.S. natural gas futures surged by more than 45% in just two trading days as a brutal Arctic air mass descends on the eastern United States. The early-week rally sent prices to levels not seen in months, underscoring how extreme weather can rapidly reshape energy…

-

Trump’s Energy Promises One Year In: Bills, Drilling, and Production

Promises vs. reality: where the energy agenda stood after one year During the 2016 campaign, Donald Trump pledged to dramatically lower Americans’ energy costs and unleash a surge of U.S. production with the rallying cry to “Drill, baby, drill.” One year into his presidency, the promises face a mixed set of results. While there has…

-

Trump’s Energy Promises After One Year: A Look at Bills and Production

Overview: A campaign pledge under the microscope During the 2016 campaign, then-candidate Donald Trump framed energy policy as a key lever for the economy and price relief. He repeatedly promised to cut Americans’ energy bills in half, promote cheaper gasoline and electricity, and to “unleash” American energy production. One year into his term, observers and…

-

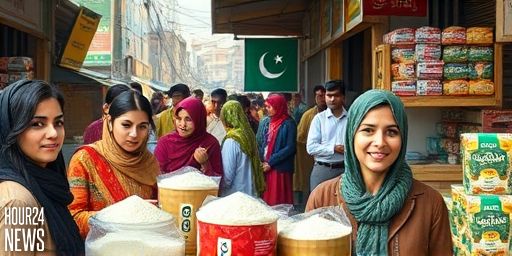

SPI Up 3.87% YoY as Pakistan Faces Food and Fuel Pressures

Pakistan’s SPI Climbs 3.87% YoY The Sensitive Price Indicator (SPI) for the week ending January 15, 2026, shows a 3.87% year-on-year increase, underscoring persistent cost pressures on Pakistani households. While some prices may ease in certain categories, the overall SPI reading reflects a broad inflationary trend affecting essential items such as flour and energy costs.…

-

SPI Up 3.87% in Pakistan: Weekly Inflation Push

Pakistan’s SPI Climbs 3.87% YoY for Week Ended Jan 15, 2026 The Sensitive Price Indicator (SPI) in Pakistan rose by 3.87% year-on-year for the week ending January 15, 2026. The latest data point underscores persistent price pressures on essential household items, even as some categories show marginal easing. The week’s uptick is closely tied to…

-

SPI Up 3.87% as Flour and Gas Prices Weigh on Karachi Households

Overview: SPI Increases for a Second Consecutive Week The Sensitive Price Indicator (SPI), Pakistan’s weekly gauge of inflation driven by essential consumer goods, rose by 3.87% year-on-year for the week ending January 15, 2026. The uptick signals sustained price pressures on households across major expenditure categories, even as some non-food items show relative stability. In…

-

I Had No Electricity for Six Months: How Soaring Energy Prices Hit American Families

Rising Energy Costs Strain American Families When Kristy Hallowell lost her job, she faced a new kind of hardship: an energy bill that tripled to $1,800 a month. What followed was not just financial stress but a breakdown in daily life as gas and electricity were cut off. For six long months, her family relied…

-

What the US strike in Venezuela means for gas prices and oil markets

Overview: A shock to the oil landscape The announcement of a large-scale US strike on Venezuela and the subsequent capture of its leadership has sent tremors through global oil markets. Venezuela holds one of the world’s largest proven oil reserves, and any disruption to its output can ripple through prices at the pump and beyond.…

-

What the US Strike in Venezuela Could Mean for Gas Prices and Oil Markets

Overview: A Disruptive Event in a Major Oil Provider Any sustained disruption in Venezuela’s oil operations can ripple through global energy markets. Venezuela holds one of the world’s largest proven oil reserves, though its production has been constrained by decades of underinvestment and political turmoil. A significant U.S. strike, whether executed to target oil infrastructure,…