Tag: Commodity prices

-

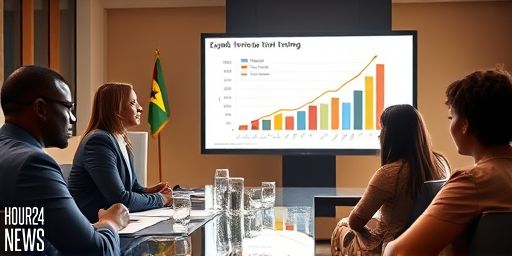

Ghana’s Gold-Driven Surge: Exports Hit US$31.1 Billion in 2025

Overview: A Robust End to 2025 Ghana finished 2025 on a notably strong external balance, with total export earnings reaching US$31.1 billion. This marks a sharp increase from US$19.1 billion recorded in 2024, underscoring a year of vigorous commodity demand and favorable price movements. The preliminary data, published by the Bank of Ghana in its…

-

Global LNG Supply Surge Sparks Near-Term Price Slump

Overview: An Awakened LNG Market The global liquefied natural gas (LNG) market faces a notable shift as new export projects come online and existing facilities ramp up production. Analysts expect a roughly 10% year-on-year increase in global LNG supply, a development likely to relieve previous tightness and put downward pressure on prices in the near…

-

Global LNG Supply Surge Threatens Near-Term Price Slump

Overview: A Market Moving toward Abundance The global liquefied natural gas (LNG) market is moving from a period of tight supply into a potential surplus, with analysts predicting a roughly 10% year-on-year increase in global LNG supply. New export projects coming online, along with rapid ramp-ups at recently commissioned facilities, are reshaping the balance between…

-

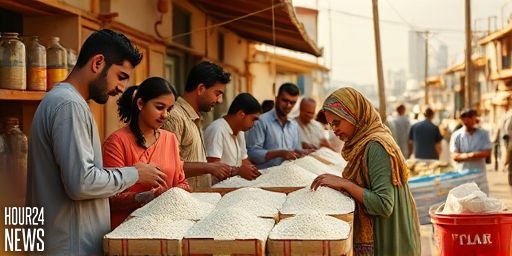

SPI Up 3.87% as Flour and Gas Prices Weigh on Karachi Households

Overview: SPI Increases for a Second Consecutive Week The Sensitive Price Indicator (SPI), Pakistan’s weekly gauge of inflation driven by essential consumer goods, rose by 3.87% year-on-year for the week ending January 15, 2026. The uptick signals sustained price pressures on households across major expenditure categories, even as some non-food items show relative stability. In…

-

Venezuela Oil Supply to Rise, Pressure Prices: Analysts Say

Growing Venezuelan Output Seen as a Market Trigger Analysts believe Venezuela’s crude production is poised to rise in the coming years, potentially reshaping global oil markets. The shift follows a sequence of political and military events that disrupted normal operations but could ultimately unlock spare capacity in one of the world’s largest oil reserves. While…

-

Five key things to watch on the ASX 200 this Friday

Five key things to watch on the ASX 200 this Friday The S&P/ASX 200 pulled back slightly on Wednesday, ending at 8,714.3 points after a tough session. As traders gear up for Friday, investors will be eyeing several factors that could determine whether the market can regain its footing and close the week on a…

-

FTSE 100 Surges as Lloyds, Miners Lead; Gold Breaks $4,000 Again

FTSE 100 hits fresh intraday highs as banks and miners drive gains The London market moved decisively higher on Wednesday, with the FTSE 100 punching through key levels as a blend of financials and miners spearheaded the rally. By late trading, the index was hovering around the 9,550 area, having touched intraday highs near 9,577.08…