Tag: Central Bank

-

What to Expect from Interest Rate Cuts in 2026: Nigeria’s Path to Stabilizing Inflation and the Naira

Overview: A 2026 Outlook Centered on Inflation and Currency Stability As 2026 unfolds, Nigerian policymakers appear committed to using monetary tools to wave-proof the economy against inflationary pressures and currency volatility. Polls and analyst commentary cited by BusinessDay suggest that the central bank will keep the monetary policy rate (MPR) above the 22% threshold for…

-

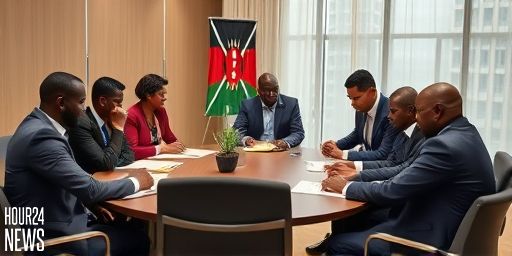

Kenya’s 2026 Economy: The Players Guiding Growth and Reform

Introduction: The new echelon of economic influence As Kenya enters 2026, the economy is no longer steered by a single vision or a handful of power brokers. Instead, a broader coalition is shaping policy, investment, and productivity at the intersection of politics, capital, regulation, and corporate power. With the 2027 General Election already on the…

-

Zimbabwe to Continue Mineral Purchases in 2026, Central Bank Governor Says

Overview: A strategic push to strengthen reserves Zimbabwe intends to continue its policy of strategic mineral purchases in 2026 as a cornerstone of efforts to bolster the nation’s foreign currency reserves. Central bank governor John Mushayavanhu outlined the plan, highlighting how mineral acquisitions are being leveraged to diversify Zimbabwe’s assets and improve liquidity in the…

-

Zimbabwe to Continue Mineral Purchases in 2026 to Build Foreign Reserves as ZiG Plans Advance

Zimbabwe Signals Continuation of Strategic Mineral Purchases in 2026 Zimbabwe is reinforcing its strategy to strengthen its foreign currency reserves by continuing strategic purchases of minerals in 2026. Central bank officials say the move aligns with the country’s broader objective of stabilizing its economy while advancing the transition to a sovereign digital currency, the ZiG,…

-

Zimbabwe Says It Will Continue Mineral Purchases in 2026 to Fortify Reserves Ahead of ZiG Currency Rollout

Zimbabwe Signals Continued Mineral Purchases in 2026 to Boost Forex Reserves Zimbabwe is signaling that it will maintain strategic mineral purchases in 2026 as part of a broader effort to strengthen the nation’s foreign currency reserves. The move comes as the central bank tightens policy and accelerates preparations for the planned adoption of the ZiG,…

-

Why Over 80% of America’s Top CEOs Think Trump Would Be Wrong Not to Pick Chris Waller for Fed Chair

CEO Consensus: A rare moment of unity on the Fed chair question When a diverse group of the nation’s top business leaders weighs in on the Federal Reserve chair, the message carries weight beyond typical political chatter. A surprising majority—reported as over 80%—of America’s leading CEOs believe that if President Trump were to appoint a…

-

Naira Strengthens To ₦1,456/$ At Central Bank FX Window

Overview: Naira Rises at the Central Bank FX Window The Nigerian naira strengthened against the US dollar at the official foreign exchange window on Monday, rising by about 0.54% to approximately ₦1,456.56 per $1. This marked a notable uptick as liquidity pressures in the FX market began to ease, signaling renewed optimism for importers and…

-

Inflation Falls, but Jobs Market Alarm Bells Ring

Inflation Ease Opens a Window, but the Jobs Picture Clouds the Outlook November’s consumer price data offered one clear headline: inflation is easing. Across the board, prices are falling compared with the previous month, and the annual rate dipped to 3.2% from 3.6% in October. Goods price inflation slowed to 2.1% (down from 2.6%), while…

-

Inflation Drops but Jobs Market Starts to Murmur: What It Means for the Economy

Inflation Drops Across the Board Recent monthly data show a broad-based decline in prices, with the annual inflation rate easing to 3.2% from 3.6% in the previous month. The trajectory signals a cooling economy, but the pace of improvement remains tethered to how different sectors behave. Goods prices have fallen more rapidly, dipping to 2.1%…

-

Why Michele Bullock Cancelled the RBA Christmas Party: A Cost-of-Living Consideration

Background: A Decision Rooted in Perception In a move that blends workplace governance with public accountability, Michele Bullock, the governor of the Reserve Bank of Australia (RBA), cancelled the institution’s Christmas party. The decision, described by Bullock as a response to potential negative perceptions from the broad public—especially the “man in the street who is…