Pakistan Nears Reko Diq Revival With $3.5 Billion Financing

Pakistan’s historic Reko Diq copper-gold project in Balochistan has moved a major step closer to fruition after a $3.5 billion financing package was finalised with six international financial institutions. The agreement signals a significant milestone for one of the country’s most ambitious mineral ventures, aligning government aims with international capital to unlock the province’s vast ore potential.

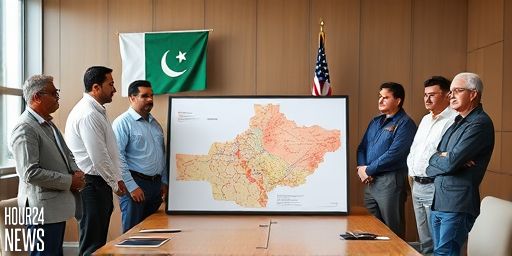

The financing package reportedly includes commitments from a constellation of leading lenders, including US Export-Import Bank (US EXIM), the Asian Development Bank (ADB), the International Finance Institutions, the International Development Association (IDA), and the European Bank for Reconstruction and Development (EBRD). While the project sponsors – the federal government and Barrick Gold Corporation – signed the agreement, final approvals from the lenders’ boards are still pending. Once cleared, disbursement could begin within 45 to 90 days, subject to meeting the stipulated conditions.

The deal structures a favorable borrowing framework for Pakistan, offering a four- to five-year grace period and a 12-year repayment schedule with single-digit interest rates. Officials say the arrangement could help accelerate project execution and reduce near-term fiscal pressure on the government, provided prerequisites are completed on schedule. If all conditions are met on time, the first tranche could be released within two months, kick-starting the long-awaited development phase.

The Reko Diq project, located in Chagai and Tor Ghar districts of Balochistan, has long been poised as a cornerstone of Pakistan’s mineral wealth. The project’s scale and potential economic impact have attracted major international interest, with Barrick Gold as a primary sponsor and a consortium of local and national stakeholders involved in the equity structure.

Equity Structure and Key Stakeholders

Under the agreed equity split, Barrick Gold is set to hold 55 percent, reflecting its role as the lead partner. The remaining 27.7 percent will be jointly held by Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Limited (PPL). The Balochistan provincial government will maintain a 16.6 percent equity stake through its state agencies and entities. This distribution underscores a blend of international investment and local ownership that policymakers say aligns with national development goals.

With an estimated total project cost of about $7.7 billion, Reko Diq is projected to begin production by the end of 2028. Official projections estimate the project could generate approximately $53 billion in total revenue over its lifetime. The fiscal and equity implications are multifaceted: Balochistan is expected to receive roughly $11 billion in fiscal revenues, with $6 billion as its provincial share and about $9 billion realized via equity held by Balochistan Mineral Resources Limited. The federal government is anticipated to derive around $11 billion in fiscal revenues, while Pakistan Minerals Private Limited could see around $15 billion in equity inflows.

Economic Impacts and Prospects for Pakistan

Beyond direct revenues, Reko Diq promises broader economic spillovers for Pakistan. Local employment, skill development, and indirect industrial activity could rise as construction and later production scale up. The project also places Balochistan at the center of a minerals-led growth trajectory, potentially attracting ancillary investment and improving regional connectivity and infrastructure. Critics and supporters alike will be watching closely how procurement, local content, and environmental safeguards are implemented as work proceeds.

Analysts note that the new financing arrangement could set a benchmark for future large-scale resource projects in Pakistan, combining concessional terms with strong governance standards. The involvement of reputable international lenders signals a high degree of due diligence and risk management, which could help reassure capital markets and local stakeholders about the project’s long-term viability.

What Comes Next?

Officials emphasize that final lender board approvals remain the gating item. If approvals are secured, the disbursement timeline is contingent on meeting all covenants and milestones laid out in the financing agreement. The government and project sponsors are expected to maintain momentum, with regular updates to parliament and provincial authorities as the project transitions from financing to construction and eventually production.

As the Reko Diq revival advances, Pakistan’s mineral sector could receive a significant uplift, reinforcing the country’s role as a key player in regional resource development. Observers will be keen to see how the project aligns with broader energy and industrial strategies, including local content rules, environmental protections, and transparent revenue-sharing mechanisms.