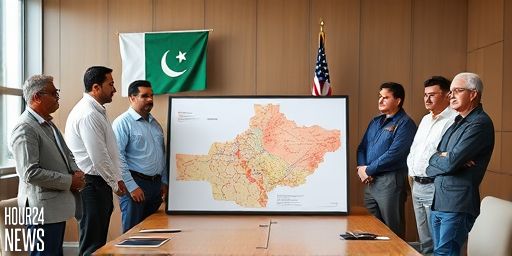

Overview: A Milestone for Pakistan’s Mining Ambitions

Pakistan is poised to revive the historic Reko Diq mining project in Balochistan after finalising a $3.5 billion financing package with a consortium of six major international financial institutions. The accord marks a watershed moment for one of the country’s most ambitious mineral ventures, signaling strong international confidence in the project’s potential and in Pakistan’s ability to execute large-scale natural resource development.

Key Players and Structure of the Deal

The financing package is anchored by prominent lenders, including the US Export-Import Bank (US EXIM), the Asian Development Bank (ADB), the International Finance Institutions, the International Development Association (IDA), and the European Bank for Reconstruction and Development (EBRD). The agreement was signed by the project sponsors—the federal government and Barrick Gold Corporation—alongside local partners, with final approval from the lenders’ boards still pending. If sanctioned, disbursements could begin within 45 to 90 days after approval, subject to meeting all conditions outlined in the deal.

Favorable Financing Terms

Officials highlighted a favorable financing framework, featuring a grace period of four to five years and a repayment schedule spread over 12 years. The loan is expected to carry a single-digit interest rate, a critical factor that could significantly reduce early-stage financial pressure on Pakistan as the project ramps up. If prerequisites are met on time, the first tranche could be released within about two months, accelerating the timeline toward construction and eventual production.

Equity Structure and Local Beneficiaries

The equitable arrangement places Barrick Gold with a 55% stake, while state-owned Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Limited (PPL) hold a combined 27.7%. Balochistan’s government will retain a 16.6% equity stake, underscoring provincial participation in the project. This distribution aims to balance foreign expertise and investment with national and regional ownership, potentially aligning interests with long-term revenue streams for the province.

Economic Impact and Revenue Projections

With an estimated total project cost of around $7.7 billion, Reko Diq is expected to commence production by the end of 2028. Projections estimate the project could generate roughly $53 billion in total revenue over its lifetime. Fiscal implications include an estimated $11 billion in federal revenue and about $11 billion in revenue for the broader national economy via various channels. Balochistan stands to gain approximately $6 billion in provincial revenue and $9 billion through equity held by Balochistan Mineral Resources Limited. Pakistan Minerals Private Limited is projected to benefit from around $15 billion in equity inflows, illustrating a broad distribution of economic gains across federal and provincial levels and state-backed entities.

Strategic Significance for Pakistan

The Reko Diq revival is more than a single mining project; it represents a strategic push to diversify Pakistan’s economy, attract long-term investment, and demonstrate the country’s capability to manage complex, multi-stakeholder ventures. The deal aligns with broader development goals, including job creation, technology transfer, and strengthened capacity in resource governance. For Barrick Gold, the partnership offers access to one of the world’s most mineral-rich regions, while Pakistan gains a durable platform to advance its mineral portfolio and related infrastructure development.

Next Steps and Timing

With lender boards expected to grant final approvals imminently, the project team will proceed to meet conditions precedent, initialize procurement, and mobilize on-ground activities. If all goes as planned, the first tranche of financing could reach the project within two months, setting the stage for construction and the long-awaited production timeline. Stakeholders continue to emphasize transparency and compliance to ensure sustained momentum and to maximize the social and economic benefits for Balochistan and Pakistan as a whole.

Conclusion: A Turning Point for Pakistan’s Mineral Wealth

The $3.5 billion financing deal for Reko Diq signals a major turning point in Pakistan’s mineral development trajectory. As the project moves toward production by 2028, its potential to generate substantial revenue, attract further investment, and strengthen regional ties makes it a focal point of national economic strategy and international partnership in the resource sector.