Overview

Gold rate today on 29 September shows a modest easing after a rapid ascent earlier in the year. While the metal remains near year to date highs, the daily move is small, giving buyers and investors a moment to reassess their positions.

Today Rate and Market Context

As trading sessions unfold, the price of gold has dipped slightly compared with the recent peak levels. This pause comes after sustained gains fueled by inflation concerns and demand from physical buyers. Market participants are watching data releases and central bank signals for cues on the next directional move.

What is Driving the Movement?

Global Cues

Gold is highly sensitive to the strength of the US dollar and expectations of monetary policy. A firmer dollar or expectations of higher interest rates can cap bullion prices, while softer dollar sentiment can support safe haven buying during geopolitical tensions or economic uncertainty.

Physical Demand and Seasonal Trends

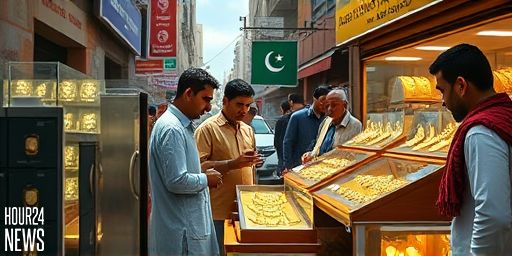

In major markets like India, gold remains a staple for weddings and festivals. Seasonal demand can push prices higher in the short term, while supply constraints or premium charges keep the price level elevated. Dealers note that while wholesale demand has cooled slightly, consumer buy interest remains steady for jewelry and investments.

Inflation and Risk Appetite

Rising inflation fears or concerns about future growth often boost gold as a hedge. If investors become risk averse, safe haven demand can reappear, pushing prices back toward the highs seen earlier in the year.

Tracking Gold Rate Today

To stay on top of price movements, check reliable sources such as local bullion dealers, exchange traded funds, and major financial portals. Compare rates per gram or per 10 grams, and account for making charges if you plan to buy jewelry. Keep an eye on international markets and the open interest in gold futures, which can give hints about bets placed by professional traders.

Tips for Buyers and Investors

For buyers looking at jewelry, timing purchases around minor dips can help reduce overall cost, but be mindful of making charges. For investors, consider diversification with gold ETFs or futures rather than large physical holdings, especially if storage and insurance costs are a concern. Short term price moves can be volatile, so align your strategy with your risk tolerance and time horizon.

Conclusion

Gold rate today on 29 September reflects a market balancing act between demand for safe haven assets and shifting cues from the global economy. While the price has softened a touch from its recent highs, the path remains buoyant as buyers watch upcoming data and central bank commentary. Staying informed helps you make prudent decisions whether you are buying jewelry, investing, or simply keeping an eye on the market mood.