Introduction

The U.S. Treasury Department has taken a significant step by proposing tariffs against both China and India regarding their dealings with Russian oil. This move comes as the financial leaders of the G7 gather to discuss strategies to exert more pressure on Russia amidst ongoing tensions due to the Ukraine crisis.

Context of the Proposal

Following the invasion of Ukraine by Russia, multiple countries, particularly in the West, have implemented sanctions aimed at crippling the Russian economy. However, countries like China and India have continued to import Russian oil at discounted prices, which poses a significant challenge to the effectiveness of these sanctions. As the G7 deliberates, the U.S. aims to ensure that these nations align with international efforts to isolate Russia economically.

Details of the Tariff Proposal

The proposed tariffs target oil imports from Russia that are being processed or resold by China and India. The intention is to make it financially burdensome for these countries to engage in transactions that are perceived as undermining global efforts to hold Russia accountable. By increasing costs on Russian oil imports, the U.S. hopes to further diminish revenues that fund the Russian government and its military efforts.

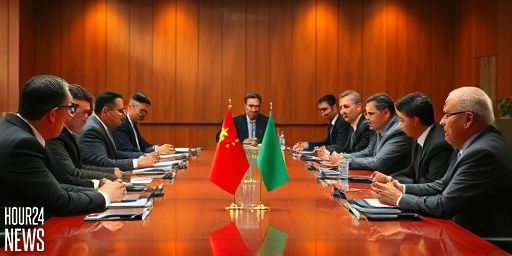

G7’s Role in the Discussion

The G7, which includes Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, represents some of the world’s largest economies. Their collective strength and unity in imposing tariffs against nations that facilitate Russian oil trade could significantly impact Russia’s economic landscape. The U.S. has emphasized that these discussions are not merely punitive but aim to foster a collective response to uphold international law and protect the sovereignty of nations under threat.

Reactions from China and India

As expected, the U.S. proposal has drawn criticism from both China and India. Both countries have maintained a position of neutrality in the conflict, emphasizing their rights to trade and source energy according to their national interests. Chinese officials have described the move as an unwarranted attempt to exert pressure on sovereign nations, while India has reiterated its commitment to energy security and the economic needs of its population.

The Implications of Tariffs

If implemented, these tariffs could shift global oil prices and create a ripple effect in energy markets. Countries that rely on Russian oil may face increased costs, which could affect various sectors, especially those dependent on energy-intensive operations. Moreover, the move could strain diplomatic relations further, complicating discussions on other global issues where cooperation is crucial.

Conclusion

The proposal for tariffs against China and India by the U.S. Treasury reflects a strategic attempt to tighten the screws on Russia during a critical period. As the G7 meetings unfold, the effectiveness of such measures in shaping the geopolitical dynamics surrounding the Ukraine crisis remains to be seen. The outcome could redefine energy cooperation and trade relations on a global scale.