Overview: A hands-on approach to Pakistan’s investment climate

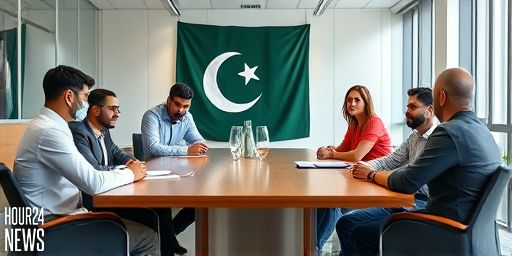

Bilal Azhar Kayani, the Minister of State for Finance, convened an interactive session in Islamabad as part of a broader series aimed at aligning Pakistan’s economic policy with the needs of its business community. The gathering brought together leading representatives from the country’s private sector to discuss the pressing investment challenges facing Pakistan today, as well as practical policy responses from the government’s Special Investment initiative. The session underscored the government’s commitment to maintaining an open dialogue with industry to foster a stable and attractive climate for investment.

Key topics: Economic headwinds and policy levers

Participants delved into a range of topics critical to sustaining investment and long-term growth. Central among them were macroeconomic stability, fiscal discipline, and the role of public-private partnerships in infrastructure development. Stakeholders emphasized the need for predictable policy environments, transparent regulatory processes, and timely capital deployment to support key sectors such as energy, manufacturing, and technology. The minister outlined ongoing measures to streamline investment approvals, reduce red tape, and incentivize private capital for projects that enhance export capacity and job creation.

Investment climate: Addressing risk and unlocking capital

The discussion highlighted both the risks and opportunities in Pakistan’s investment landscape. Participants noted that while global capital remains cautious amid volatility, targeted reforms—especially in energy pricing, credit availability, and ease of doing business—could unlock significant inflows. The minister signaled a continued push to improve risk-adjusted returns for investors through macro-stability, improved governance, and dedicated support for export-oriented ventures. The session also explored mechanisms for faster dispute resolution and stronger protections for minority investors, which are essential to sustaining long-term capital inflows.

Private sector priorities: Efficiency, transparency, and growth

Business leaders outlined practical priorities that could drive near-term growth: simplifying permits and licensing, expanding access to affordable finance, and providing targeted incentives for small and medium-sized enterprises (SMEs) that connect to regional value chains. They called for credible medium-term fiscal plans that balance revenue generation with growth-friendly spending, emphasizing the importance of investment in critical infrastructure, digitalization, and workforce development. The dialogue stressed the role of the Special Investment initiative as a bridge between policy intent and real-world project execution.

Government response: A roadmap for a more investable Pakistan

Minister Kayani used the session to reiterate the government’s commitment to creating a more predictable and transparent investment framework. He highlighted ongoing reforms designed to improve governance, reduce project timelines, and enhance the ease of accessing capital for business ventures. The government also signaled readiness to implement targeted incentives in priority sectors, paired with rigorous monitoring to ensure funds deliver measurable economic benefits, including job creation and export growth.

Outcomes and next steps: Turning discussion into action

While the session was advisory in nature, it produced a clear set of next steps. Participants agreed to ongoing exchanges through a structured feedback loop with the Special Investment office, ensuring that policy proposals translate into concrete actions. The team plans follow-up sessions focused on sector-specific challenges, financing gaps, and the development of scalable public-private partnerships that can attract both local and foreign investment. The overarching goal is to build a more resilient economy that can withstand global shocks while expanding opportunity for Pakistani businesses and workers.

Why this matters: Aligning policy with business realities

Engagements like this reflect a proactive approach to economic governance—one that prioritizes dialogue with the private sector to align policy design with ground realities. For investors, the message is that the government is listening, with a clear pathway to reforms and support mechanisms that can improve returns and reduce uncertainty. For Pakistan’s business community, the evolving policy framework promises a more stable, transparent, and opportunities-driven environment in which to grow and compete on regional and global scales.