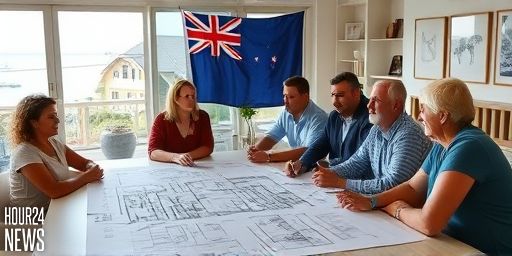

Family dispute centers on a dream beachfront manor

A high-stakes rift is simmering in Sorrento, the coastal town famed for its pristine bays and luxury homes. At the heart of the disagreement: a set of ambitious plans to build a $3 million beachside residence on a prized oceanfront site. The siblings, who stood together as children of a late property developer, now find themselves echoing the very family dynamics that once inspired their parent’s entrepreneurial spirit.

What began as a family project has evolved into a complex legal and emotional battle. The siblings disagree about who should control the project, how the funds should be allocated, and what would constitute a fair outcome if the property cannot be developed as planned. The case has attracted attention not merely for its monetary value but for what it reveals about intergenerational wealth, succession, and the pressures of real estate in Australia’s hot markets.

Why the Sorrento site matters

The proposed build isn’t just a residence; it’s a signal of status and a potential anchor for long-term family wealth. Sorrento’s bayside location offers strong resale values and an enviable lifestyle that many buyers covet. For siblings, the site carries memories of shared holidays, family dinners, and the sense that the property once represented a tangible link to a parent’s legacy. Yet memories can complicate modern planning when multiple heirs have different visions for how to honor that legacy.

Legal angles: wills, trusts, and decision-making power

The dispute has moved beyond personal grievances into the realm of wills and trusts, a common flashpoint in Australian estates involving significant real estate. Experts note that when a property is owned by multiple parties or held in a family trust, decisions about development often require consent from a majority or a legally designated executor. Without clear authority, plans can stall while legal arguments flourish, delaying a project that parties may have counted on for years.

In many such cases, the courts encourage mediation or private arbitration to avoid protracted litigation that can erode asset value through delays, costs, and inflated construction estimates. For the siblings here, a negotiated arrangement—perhaps a buyout, a partition, or a mutually agreed-upon development timeline—could preserve capital while reducing ongoing tensions.

Economic stakes and market realities

Even for Australia’s most buoyant markets, a $3 million project carries significant risk. Construction costs have fluctuated, and planning approvals can become a moving target in busy coastal communities. A project of this scale requires precise budgeting, expert forecasts, and clear governance among co-owners. In practice, the absence of a cohesive plan often leads to cost overruns, delays, and disputes over contractor selection and architectural direction.

What comes next for the siblings?

Several potential pathways exist. A formal mediation could yield a settlement that preserves family harmony while safeguarding the investment. A court order might set a framework for decision-making if negotiations fail, but such an outcome often comes with reputational and financial costs. Alternatively, the siblings could agree to an external manager or development partner who would execute the project under predefined milestones.

Implications for other families facing similar disputes

Cases like this are reminders that wealth matters as much as sentiment when large estates are involved. Property lawyers advise families to document decision-making powers clearly in wills and trusts, outline dispute-resolution steps, and align expectations about how future gains will be distributed. For stakeholders in Sorrento, transparent governance could mean the difference between a landmark home and a source of ongoing contention.

As the sun casts its glow over Sorrento’s shoreline, the family must decide whether to let history guide their plans or to rewrite the narrative with a structured, principled approach. The outcome will not only determine the fate of a single beachfront project but also illuminate how similar disputes can be resolved in Australia’s competitive property market.