Gold Prices in Pakistan Today

Gold prices in Pakistan today reflect a powerful global rally in bullion markets, underscoring the close link between international trends and domestic rates. As investors worldwide seek a safe haven amid economic uncertainty and inflationary pressures, Pakistan’s local gold market has followed suit, pushing local rates to new highs. The latest movements come on the back of a robust performance in the international gold market, where bullion has enjoyed sustained gains in recent sessions.

What’s Driving the Rally?

The surge in gold prices is driven by a combination of factors. A stronger dollar has often clashed with bullion when risk sentiment shifts, yet many traders view gold as a hedge against currency depreciation and rising inflation. In addition, geopolitical developments, central bank policy expectations, and fluctuations in real yields have all contributed to this volatility. These global dynamics translate into higher prices for buyers in Pakistan, where import costs and local demand also influence the rate card for gold and related products.

International Bullion Trends

On the international stage, gold has risen significantly as investors react to economic data and the outlook for central bank tightening. The recent rally has lifted spot prices and futures contracts, creating a benchmark that Pakistani markets closely monitor. Local buyers react to these movements because domestic gold rates are typically anchored to global gold prices, with the rupee-Dollar exchange rate playing a complementary role in determining the final price now quoted at the bullion markets in major cities like Karachi and Lahore.

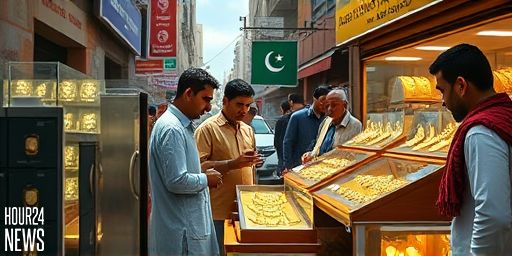

Local Market Impact

In Pakistan, the price of gold is quoted per tola and per gram, with jewelry demand also influencing short-term fluctuations. When international prices climb, local prices tend to follow, even as the rupee’s performance against the dollar adds another layer of complexity for traders and consumers. This means sellers in retail and refined markets may temporarily adjust margins, while investors who use gold as a portfolio hedge may respond to the new rate levels with cautious buying or profit-taking strategies.

Silver and Investment Alternatives

While gold remains the leading choice for many Pakistani investors seeking wealth preservation, silver has also attracted attention as a more affordable entry point into precious metals. The current market conditions support a diversified approach, with some buyers pairing gold purchases with silver or other assets to balance risk. Financial experts suggest evaluating long-term goals, liquidity needs, and storage considerations when deciding how much to allocate to bullion versus other investments.

Guidance for Buyers

For shoppers and investors in Pakistan today, it’s important to monitor both international gold prices and local rate announcements from reputable bullion outlets. Consumers should check the current price per tola and per gram, while also considering making purchases during periods of softer local fluctuations. Keeping an eye on the rupee’s stability and any changes in import duties or regulatory policies can help buyers time their acquisitions more effectively.

Looking Ahead

Analysts suggest that the ongoing global demand for safe-haven assets could keep gold on an upward trajectory in the near term, particularly if inflation pressures persist or if central banks signal a continued hawkish stance. For Pakistan, this could translate into sustained high prices in the local market, along with opportunities for traders and jewelers alike. As always, informed planning and prudent budgeting will be essential for those deciding to invest in or purchase gold in today’s market.