Overview: A Tempting But Temporary Rebound

China’s latest data show a rebound in consumer prices, driven largely by higher food costs and a late-year surge in holiday shopping. While the uptick in the consumer price index (CPI) may appear to signal renewed demand, economists warn that deflationary pressures could reassert themselves if the economy lacks more forceful stimulus and policy support. The nuance matters not just for Chinese households facing higher groceries and energy bills, but for global markets watching inflation dynamics in the world’s second-largest economy.

What Is Behind the CPI Rise?

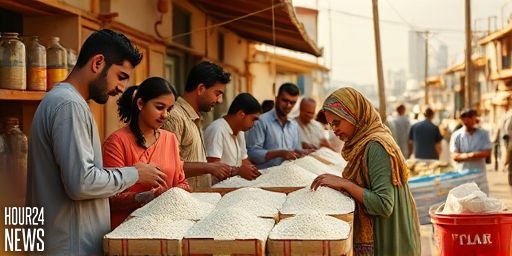

The recent CPI uptick is being attributed primarily to a jump in food prices. In a country with a food-intensive consumption basket, even modest increases in meat, fresh produce, and poultry can push overall inflation higher. Seasonal holidays typically encourage stronger consumer spending, and retailers often raise prices on popular items during peak periods. In this context, the observed CPI move may reflect a temporary mix of weather-driven supply constraints and robust but uneven demand.

Why Deflation Remains a Central Risk

Despite the short-term bounce, deflationary forces remain a concern for policymakers. A deflation risk arises when consumer demand softens, wages stagnate, and debt sustainability becomes a challenge for households and firms. In China’s case, lingering weakness in investment, real-estate headwinds, and external demand pressures can dampen price growth even as some prices rise in specific sectors. The balance between enduring disinflationary trends and isolated price pressures will shape policy discussions in the coming months.

Policy Implications and Potential Stimulus Paths

Analysts are watching for signals about the direction of monetary and fiscal policy. If inflation cools quickly again, the risk is that authorities pull back stimulus measures too soon, potentially weakening growth momentum. Conversely, more decisive support—such as targeted credit expansion, infrastructure investment, or measures to bolster consumer confidence—could help anchor price levels and prevent a sustained deflation path. The challenge for policymakers is to tailor stimulus in a way that supports demand without reigniting unhealthy debt accumulation or creating asset-price distortions.

What to Look For Next

Key indicators to monitor include the upcoming CPI readings, producer prices (PPI), and wage growth. A softening PPI alongside weak wages could signal broad-based deflationary pressures, even if headline CPI nudges higher due to food costs. Market participants will also scrutinize seasonal patterns in consumer demand and any policy signals from the central bank or fiscal authorities about support measures. International observers will assess how China’s price dynamics interact with global supply chains, commodity markets, and trade conditions.

Bottom Line: A Fragile Balance

China’s temporary rebound in consumer prices underlines a central tension: rising food costs and holiday demand can momentarily lift inflation, but underlying deflationary risks persist in the absence of stronger policy ballast. For households, the immediate concern is whether rising essentials outpace wage gains. For policymakers, the question is whether measured stimulus and structural reforms can sustain a healthier price level without overheating growth. The coming quarters will reveal if the rebound is a genuine shift in demand or a transient blip that deflation watchers should continue to monitor.