Singapore’s Durian Fever Grows as Musang King Prices Hit Record Lows

Durian lovers in Singapore are greeting the peak durian season with enthusiastic spirits as the coveted Musang King varieties from Malaysia flood the market at lower prices. After a long stretch of tight supply and high prices, farmers’ bumper harvests across Johor and neighboring regions have driven costs down, turning a traditionally premium treat into a more accessible indulgence for many shoppers.

What’s Behind the Price Dip?

Analysts point to a combination of factors: a robust harvest, favorable weather that boosted fruit size and sweetness, and an uptick in export volumes from Malaysia. Market stakeholders say the supply glut was anticipated by retailers, who began discounting earlier in the season to clear stocks before new batches rolled in. The result is a temporary window where Musang King—often billed as the “king of fruits”—is more affordable for households and casual buyers alike.

Impact on Local Markets

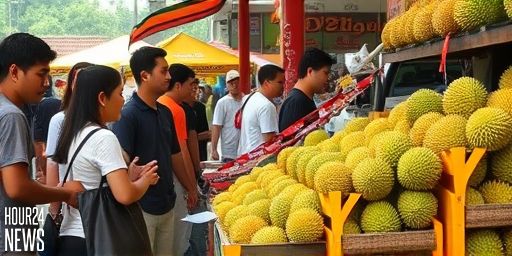

In Singapore, durian vendors and fruit markets report brisk sales with more customers willing to upgrade from regular Musang King to premium grades, such as late-season selections that historically carried heftier price tags. Retailers note that while the flash sale vibe is unusual for Musang King, the strong demand remains intact, signaling a healthy market mood as the fruit’s season peaks. Some shops even extended opening hours to accommodate crowds of enthusiasts making up for the shorter months when prices are steep.

Consumers’ Perspective

For many Singaporeans, durian trips are a ritual. The drop in price doesn’t just encourage more frequent purchases; it also broadens the demographic reach. Families with children, students, and casual buyers who once eyed durian as a special-occasion purchase now view it as a regular seasonal snack. Social media feeds buzz with reviews of different Musang King batches, and taste comparisons become a weekend pastime for durian aficionados who relish discussing flesh texture, aroma intensity, and sweetness levels.

How Vendors are Adapting

Vendors are employing smart pricing strategies to manage the surge while keeping customers satisfied. Some are offering bundled deals—discounts on multiples, or pairing Musang King with other popular fruits—to attract hesitant buyers. Others are highlighting the fruit’s distinct features, such as creamier texture and richer flavor, while offering smaller portion sizes so curious first-timers aren’t overwhelmed by a full durian purchase. The drop in price has also encouraged better stock rotation, minimizing waste and ensuring fresher selections reach consumers.

What This Means for the Kuala Lumpur-Singapore Corridor

Beyond immediate consumer gains, the price dynamics reflect broader cross-border trade patterns. Malaysia’s temporary price lull is shaping Singaporean buying behavior, which in turn informs how retailers plan future orders, manage supply chains, and price Musang King in the coming months. If Malaysia’s harvest continues to outpace demand, Singapore’s market could see sustained lower prices, at least in pockets of the season. Conversely, as demand meets supply, prices are likely to rebound, encouraging buyers to time their purchases strategically.

Seasonal Outlook

Experts caution that durian markets can be volatile, with weather, harvest quality, and export policies all capable of shifting prices rapidly. For now, shoppers should seize the moment while Musang King is more affordable but remain mindful of quality cues—firmness of the flesh, vibrant aroma, and absence of overly darkened sections—to distinguish ripe fruit from underdeveloped batches. Vendors emphasize checking the fruit’s weight, stem condition, and shell thickness as practical indicators of value during price-sensitive periods.

Conclusion

The current spike in Singaporean Musang King purchases showcases durian’s enduring appeal and its ability to adapt to market cycles. As Malaysians reap the benefits of a strong harvest, Singaporeans enjoy a temporary, more accessible opportunity to savor one of Southeast Asia’s most iconic fruits. Whether this price dip becomes a lasting trend or a fleeting anomaly will depend on the next round of harvests and how quickly supply can re-balance with demand.