Background: What Sparking the Controversy?

The Minority Caucus of the House of Representatives is calling on the Federal Government to suspend the implementation of newly proposed tax laws amid growing concerns over alleged alterations and irregularities. The controversy centers on changes made to key provisions during the legislative and executive review process, raising questions about transparency, due process, and fiscal impact on citizens and businesses.

What the Minority Caucus Is Asking For

Leaders of the Minority Caucus have urged the government to pause the rollout of the tax framework until a full audit and public consultation can occur. They argue that abrupt adoption without addressing alteration allegations could undermine public trust and complicate compliance for taxpayers. The call to suspend is framed as a precaution to ensure the final law reflects the will of the people and adheres to constitutional and legal safeguards.

Key Points Raised

- Allegations that essential provisions were altered without adequate legislative oversight or stakeholder input.

- Concerns about the potential economic impact on small and medium-sized enterprises, as well as vulnerable households.

- Demand for greater transparency in the lawmaking process, including access to documents and clear timelines for final approval.

- Assurance that due process and constitutional requirements will be observed before any tax policy changes take effect.

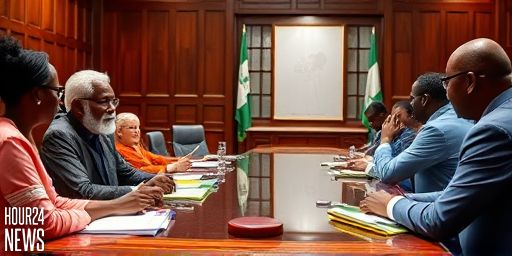

Government and Stakeholder Reactions

Reactions to the call for suspending the tax law rollout are mixed. Supporters of the minority’s position cite the need for rigorous scrutiny, especially when fiscal policies directly affect income, consumption, and investment. Government officials, meanwhile, have emphasized ongoing consultations and a commitment to reform that is equitable and efficient. Lawmakers across the aisle are watching closely, recognizing that the outcome could affect public sentiment and the administration’s credibility.

Why This Matters for Citizens and Businesses

Tax changes influence everyday life, from take-home pay to business costs and investment climates. A delay or modification based on thorough review could reduce compliance risk and ensure measures are clear, predictable, and fair. For individuals, clarity on exemptions, thresholds, and filing procedures can mitigate unintended financial burdens. For businesses, especially small firms, predictable tax regimes support planning, hiring, and growth strategies.

Next Steps and What to Expect

Analysts expect parliamentary committees to convene hearings, demand access to relevant documents, and potentially issue a ruling on whether to suspend, amend, or proceed with the new tax framework. In the meantime, stakeholders are urged to participate in consultations and review sessions to voice concerns and propose alternatives that safeguard revenue needs without stifling economic activity.

Conclusion: Balancing Reform with Accountability

The ongoing alterations controversy surrounding the proposed tax law underscores the enduring tension between reform momentum and accountable governance. The Minority Caucus’s call to suspend highlights the demand for due process and transparent governance. As Nigeria contends with fiscal pressures and a dynamic economy, the path forward will hinge on credible dialogue, rigorous scrutiny, and policies that align with public interest.