Background

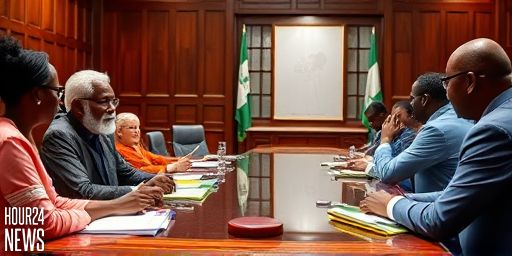

The Minority Caucus of the House of Representatives has demanded that the Federal Government pause the implementation of the newly proposed tax laws. Their call comes amid widespread concerns about alleged alterations to key provisions, which critics say could undermine fairness, transparency, and public trust in the policy process.

The Core of the Controversy

At the heart of the debate is whether the tax reform package was altered after initial discussions and what impact those changes may have on taxpayers, including small businesses and the middle class. Lawmakers in the minority argue that the changes were not adequately consulted, recorded, or disclosed to the public, raising questions about due process and the integrity of the legislative process.

Arguments for Suspension

The minority representatives emphasize three main points in favor of halting the rollout:

- Due Process Concerns: They contend that alterations were made without proper committee hearings or public comment, potentially bypassing standard constitutional procedures.

- Equity and Fairness: Tax policy critics fear that late-stage changes could disproportionately affect vulnerable groups, small enterprises, and informal sector workers.

- Economic Uncertainty: A sudden policy shift may create confusion for businesses planning budgets and investments, undermining economic stability during a fragile recovery phase.

Government Response and Next Steps

Pro-government voices have stressed that reform is necessary to modernize the tax system and broaden the revenue base. They argue that the framework is designed with safeguards and that stakeholders will have opportunities to engage in later-stage discussions. In response to the minority’s call, several committees have announced forthcoming public consultations and a review period intended to address concerns and clarify the policy’s mechanics.

Public Reactions

Public sentiment appears mixed. Some citizens welcome stronger revenue measures to fund essential services, while others fear the economic hit from higher taxes or broadened bases. The controversy has also amplified calls for greater transparency in fiscal policy, including detailed impact assessments, revenue projections, and clear timelines for implementation.

What This Means for Taxpayers

Until the debate is resolved, taxpayers may experience a period of policy uncertainty. Analysts stress the importance of clear communication about which provisions apply, how, and when. A pause could provide a window for a more inclusive dialogue, ensuring reforms are not only financially sound but broadly acceptable.

Looking Ahead

The coming weeks are crucial. With the minority caucus pressing for a suspension and the government proposing consultation processes, the tax reform’s fate may hinge on whether a transparent, participatory approach can reconcile competing interests. If successful, the policy could eventually move forward with stronger public trust and clearer implementation guidelines.

Conclusion

The alteration controversy surrounding the new tax laws highlights the delicate balance between fiscal reform and democratic legitimacy. Whether the government decides to suspend, modify, or proceed with the rollout, the episode underscores the demand for accountability, inclusive dialogue, and robust impact assessments in shaping Nigeria’s tax landscape.