Overview: A Revenue Windfall with Hidden Costs

Tariffs—fees imposed on imported goods—are delivering a sizable boost to the federal treasury. In the current debate before the Supreme Court, the central contention is not just whether tariffs are legal, but how their economic ripple effects should be measured. While government coffers grow from these duties, the broader economy bears a different set of burdens: higher prices for households, strained business margins, and a shifting landscape for U.S. manufacturers that can distort supply chains over time.

Analysts say the government collects tens of billions of dollars annually through tariffs, turning trade policy into a source of revenue rather than purely a protective measure. Yet that revenue comes with a price tag that extends beyond the balance sheet, influencing consumer budgets, business planning, and the competitiveness of American industries on the world stage.

Where the Money Goes—and Who Pays

Tariffs function as a tax on imported goods. In practice, the cost is often shared in two main ways: consumers see higher prices at checkout, and importers adjust by seeking cheaper suppliers or altering product configurations. Over time, those shifts can echo through the economy, changing which products are readily available, how much households spend on essentials, and how much capital manufacturers must dedicate to compliance and logistics.

For households, the impact is most felt in everyday items—from electronics to clothing to automotive parts. When tariffs raise the cost of inputs, retailers may pass the price increases along to shoppers. In a climate of persistent inflation, even modest tariff hikes can accumulate, eroding purchasing power and altering consumption patterns.

Businesses face a different calculus. Importers grapple with longer lead times, fluctuating costs, and the need to diversify suppliers. Manufacturers that depend on imported components may see production costs rise or experience volatility in finished goods pricing. In some cases, companies respond by increasing domestic procurement, a move that can support local jobs but also raise production expenses in the near term.

Manufacturers and Supply Chains: A Double-Edged Sword

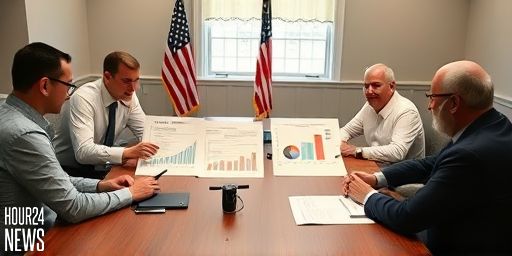

Supporters of tariffs argue the policy protects vital domestic industries and preserves jobs by reducing foreign competition. Critics counter that the real beneficiaries are not necessarily the workers on the factory floor but government revenue and consumers who face higher prices for imported goods. The Supreme Court case under discussion focuses on these trade-offs and whether tariff policy should be treated primarily as a revenue tool or a strategic instrument with broader economic consequences.

For manufacturers, the question is how to navigate a landscape where the cost of materials can swing with policy changes. Some companies push for contingency planning—holding larger inventories, developing domestic alternatives, or shifting production to friendlier trade partners. These strategies can mitigate risk but often require upfront investments and longer lead times, potentially dampening innovation and efficiency gains that come from global specialization.

Economic Trade-offs in a Globalized Market

Tariffs operate at the intersection of policy goals and real-world economics. They can deter some forms of foreign competition, stabilize certain domestic markets, or unlock needed revenue. But the price of that protection is borne by consumers and by manufacturers who must absorb higher costs or redesign supply chains. The net effect on the broader economy depends on factors such as elasticity of demand, the availability of alternatives, and the ability of businesses to pass costs to customers without losing market share.

What happens next: Policy considerations and consumer impact

Policy makers face a delicate balancing act. If tariffs are meant to safeguard national interests, they must minimize unintended consequences like inflationary pressures or reduced investment. Some observers advocate for targeted tariffs aimed at specific sectors viewed as strategically important, combined with broader measures to ease cost pressures for households and to streamline supply chains for manufacturers.

On the legal front, the Supreme Court case highlights tensions between revenue collection and economic outcomes. How courts interpret the scope and limits of tariff authority could set a precedent that shapes both fiscal policy and trade diplomacy for years to come.

Bottom line: Weighing revenue against real-world costs

The tariff debate is not simply a question of legality; it is a question of economic trade-offs. The federal government benefits from revenue, but households and manufacturers often pay the price in higher prices, disrupted supply chains, and slower adaptation to a rapidly evolving global market. A thoughtful policy approach would acknowledge these competing forces and pursue strategies that protect national interests while keeping consumer costs in check and sustaining a resilient domestic manufacturing base.