Pakistan Moves Closer to Reco Diq Revival with a $3.5 Billion Financing Deal

The long-awaited revival of the Reko Diq copper and gold project in Balochistan took a significant step forward as Pakistan finalised a $3.5 billion financing package with six major international financial institutions. The agreement signals a milestone for one of the country’s most ambitious mining ventures and has the potential to reshape regional economics if all conditions are met and disbursement proceeds on schedule.

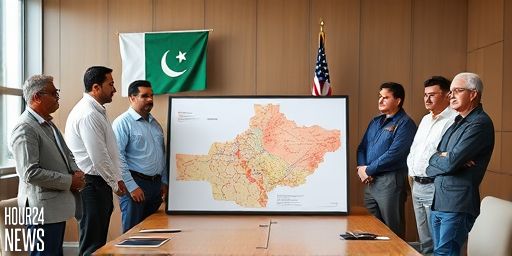

According to official sources, the financing package is anchored by commitments from globally influential lenders, including the US Export-Import Bank (US EXIM), the Asian Development Bank, and key international financial institutions (IFIs). The anticipated backing from the International Development Association (IDA) and the European Bank further strengthens the structure of the deal, with final approval from the lenders’ boards still pending. Once green-lit, disbursement could begin within 45 to 90 days, subject to the fulfillment of stated covenants and prerequisites.

what the deal means for the project

Under the terms disclosed, lenders are offering a relatively favorable borrowing environment. The package provides a four- to five-year grace period, followed by loan repayments spread across a 12-year schedule. The interest rate is described as single-digit, a feature that could substantially ease the project’s financing burden and improve its internal rate of return as construction progresses toward production.

Officials emphasise that if all prerequisites are met on time, the initial tranche could be released within two months, accelerating construction momentum for a project that has faced years of negotiations and legal complexities. Key stakeholders in Reko Diq include Barrick Gold Corporation, the Balochistan provincial government, Oil and Gas Development Company Limited (OGDCL), and Pakistan Petroleum Limited (PPL).

equity structure and expected beneficiaries

Equity arrangements place Barrick Gold with a 55% stake in the project. The joint venture between OGDCL and PPL accounts for 27.7%, while Balochistan’s government holds a 16.6% equity stake. This distribution aligns with the broader aim of keeping a strong local share in the venture while leveraging the expertise and capital of international partners.

The project is budgeted at an estimated total cost of about $7.7 billion, with operations anticipated to begin production by the end of 2028. Officials project substantial long-term fiscal and economic benefits. They estimate lifetime revenue around $53 billion, with Balochistan’s fiscal receipts totaling $11 billion and the provincial share accounting for roughly $6 billion plus an equity-related inflow of about $9 billion via Balochistan Mineral Resources Limited. The federal government is expected to gain roughly $11 billion in fiscal revenues, while Pakistan Minerals Private Limited could see about $15 billion in equity inflows.

broader implications for Pakistan’s economy and regional mining

The Reko Diq revival embodies a broader strategy to unlock mineral wealth and attract stable, long-term financing. A successful rollout would provide a template for future mega-projects in Pakistan’s resource sector, potentially easing the country’s broader investment climate and providing a clearer path to revenue diversification beyond traditional energy sectors. The role of international lenders is crucial here, offering not only capital but also governance and risk management standards that can help mitigate project risks in a volatile global commodity market.

As the boards of the involved institutions review the deal, Pakistan’s policymakers and provincial authorities are watching closely. A subsequent tranche and milestone performances—such as environmental safeguards, local employment targets, and capacity-building measures for Balochistan—will be critical in sustaining momentum and ensuring the project’s alignment with national development goals.

In the months ahead, observers will be gauging how quickly the financing can be transformed into real on-site progress, and how the project’s revenue streams will translate into broader public-sector gains for Balochistan and the federation. If all goes as planned, the Reko Diq project could become a landmark case in public-private mining partnerships in South Asia.