Overview: a new tax idea in a tense budget moment

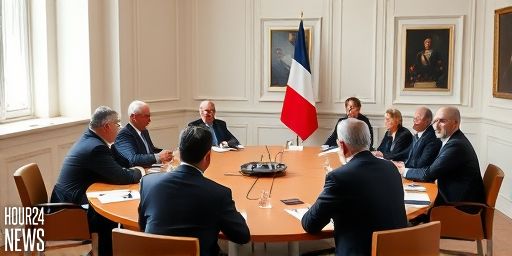

France’s Prime Minister Sébastien Lecornu met with Socialist Party leaders at Matignon on Friday amid a circuit of negotiations that followed Lecornu’s surprise decision to abandon the use of the constitutional tool known as Article 49.3. The main takeaway, according to his team, is a pivot toward a policy instrument that could affect the budget but stop short of touching professional wealth. The government has signaled it wants to advance measures aimed at improving purchasing power while keeping a broad coalition in mind.

What exactly is being proposed?

According to discussions with the Prime Minister’s entourage, the government has floated the creation of a tax on financial wealth — specifically targeting wealth held in financial structures like holding companies — that would not affect professional assets. In practical terms, the idea is to tax assets parked in finance rather than productive business capital. This distinction matters in France’s tax debate, where wealth taxes and wealth-linked levies have long been a political battleground. The government indicated that, with the 49.3 option off the table, the PS would be free to debate a broader reform, including more controversial proposals, but the cabinet does not commit to backing the Zucman-style wealth tax for the ultra-rich.

How the idea sits with the left and the right

The Socialist Party has not embraced the full Zucman plan, which would extend a tax on very large fortunes to the wealthiest households. In the current frame, the government is offering a more targeted instrument aimed at boosting purchasing power and stabilizing the budget, while leaving room for parliamentary discussion on broader equity measures. On the right, the mood is more skeptical: deputies from Les Républicains have signaled that negotiations require a substantial share of influence in government duties, and they have kept immigration and other contentious topics on the agenda as part of the bargaining dynamic.

The political landscape: who said what

Frictions and alliances shape the week’s conversations. After meeting Marine Le Pen of the National Rally, Lecornu is expected to continue talks with various opposition groups, including ecologists and the Communist party, as part of an effort to assemble a workable majority for next-year budgetary texts. The left’s demand—whether in the form of a Zucman tax on the wealthiest or a pause to the pension reform—has been rejected in public briefings as incompatible with the government’s current strategy. Still, officials stress that the budget will include measures on purchasing power, and that the door remains open to adjustments proposed by lawmakers if they strengthen economic resilience without undermining growth.

Renunciation of 49.3 and its implications

In a brief public remark, Lecornu announced he would not use Article 49.3 of the Constitution to push through the budget. The move, described as a return to a more “parliamentary” method, is framed as an invitation for responsible compromise rather than a concession to opposition demands. Observers say the decision alters the dynamics of the budget process, shifting leverage toward those who can shape a majority in the chamber without the government forcing through measures against the will of opponents.

What’s next for the budget and the reform agenda

With a new framework in place, Lecornu is expected to host more meetings with other political groups, including ecologists and additional blocs, to test which concessions could secure a vote. The socialists’ position remains pivotal: they will likely press for tax fairness and targeted relief for households while weighing how far they can go without triggering a broader split with the government’s stated priorities. Meanwhile, the opposition’s calls for more aggressive reforms—especially around pensions and immigration—will continue to shape the timetable and the tone of the debate.

Looking ahead

The government’s shift toward a finance-focused, non-49.3 budget process suggests a cautious, market-friendly approach that nevertheless leaves substantial room for parliamentary negotiation. The question for France’s political future is whether the proposed tax on financial wealth can satisfy a wide spectrum of lawmakers who seek both fairness and growth. As consultations progress, the coming weeks will test the durability of cross-party support and the government’s ability to translate select fiscal tools into tangible gains for purchasing power.