Overview

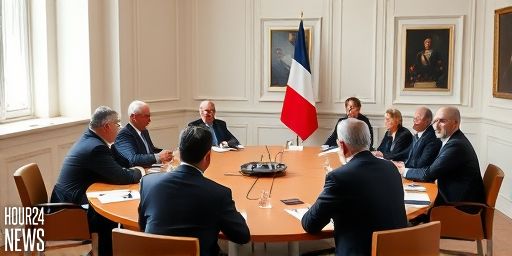

In a bid to shape the upcoming budget, the French Prime Minister proposed to the Socialist Party a new tax focused on financial wealth while explicitly ruling out support for the Zucman tax on the wealthiest households. The move comes as Matignon hosts a round of consultations with several opposition and allied groups in the run up to key votes.

What was proposed

The government signaled the creation of a tax targeting financial assets held through holding structures, but clarified that it would not touch professional wealth. The aim is to address purchasing power and social equity without risking harm to business investment and employment. The approach is presented as a cautious step toward broader fiscal reform, with room for subsequent adjustments.

Why the Zucman tax is not on the table

Sources close to the prime minister indicate a belief that the Zucman tax plan, which targets the very richest households, could threaten economic momentum. While some left leaning voices advocate for it, the government intends to keep the instrument limited to financial holdings while excluding professional wealth. This signals a willingness to compromise on tax policy without endorsing the full left agenda.

Political dynamics at play

Socialist leaders are meeting with the prime minister as part of a broader effort to secure budgetary support, while the opposition and other allies weigh in. The government has also indicated it will proceed without recourse to article 49.3 for adopting the budget, framing the process as more parliamentary and transparent. The discussions come ahead of meetings with Ecologists and other groups, with pension reform and immigration policy on the horizon.

Reactions across the political spectrum

Right wing deputies have pressed for greater government representation and scrutiny on immigration and fiscal strategy. In the National Assembly, the balance of commissions remains a dynamic battleground, with the finances committee still under opposition influence. The left keeps a watchful eye on the government, ready to escalate if red lines are crossed or if key reforms appear to stall.

What comes next

Matignon will continue hosting talks with party representatives, with the aim of building a majority for next steps on purchasing power measures and fiscal policy. The outcome will shape the government trajectory on pension reform and broader economic reform. The weeks ahead will reveal whether a feasible cross party compromise emerges that can anchor the budget and maintain momentum for the government program.

Impacts on voters and the economy

Analysts suggest that a targeted financial wealth tax could raise revenue while avoiding sweeping harm to investment. Proponents argue it addresses disparities in financial wealth, whereas critics warn about potential capital flight or evasion. The government seeks a balance between equity and growth, aiming to reassure voters dismayed by cost of living pressures while maintaining a stable economic outlook.