The Snapback Mechanism Reignites a Tense Standoff

Britain, France and Germany have activated the JCPOA’s “snapback” provision in response to what they describe as repeated and widening violations by the Islamic Republic of Iran. The step revives a dispute mechanism that could, in theory, reimpose a broad set of UN sanctions and other restrictions, underscoring the high stakes in the nuclear diplomacy framework that has persisted since 2015. Tehran, for its part, has argued that any revocation of relief contradicts the spirit of the agreement and reflects a broader political struggle with Western powers.

Analysts describe the move as dramatic and deeply consequential. It highlights the awkward position for Supreme Leader Ayatollah Ali Khamenei: on the one hand, he does not want to show weakness or bend to pressure after years of confrontation with Israel and the West; on the other hand, the regime faces mounting domestic challenges—power outages, water shortages, and a faltering economy that constrains its room for maneuver. As one scholar from a leading Israeli university noted, the leadership understands the need for some form of change, but the path remains constrained by conservatism within the system and the fear of tipping into a deeper crisis.

Iran’s Economic Struggles: Rial Devaluation and Growth Slump

The economic picture remains bleak even as the political saga unfolds. After more than a dozen quarters of growth since the 2018 U.S. withdrawal from the nuclear deal, Iran posted a marginal contraction in the second quarter of the year, shrinking by 0.1%. Industrial and mining output, which had rebounded earlier, slipped about 0.3% from a year earlier, signaling the fragility of the post-sanctions recovery under ongoing pressure and sanctions-related frictions.

Public finances and the external balance show a deteriorating trend. The central bank reported a 63% year-on-year jump in government debt to the central bank by June, while the balance of payments swung to a deficit of roughly $21.7 billion—the most for the country on record. Against this backdrop, the rial continues a steep slide, trading around 1.08 million rials per U.S. dollar on the latest market data. These indicators reflect a dual crisis: shrinking real incomes and a currency that loses value faster than many households can absorb.

“The snapback is framed by Tehran as a last option, a response to what they describe as external pressure and a perceived breach of the nuclear accord,” observed a senior analyst affiliated with Reichman University. “Yet the regime remains cautious, signaling that while it can endure external pressure, it is acutely aware of the domestic costs associated with continued isolation and economic hardship.”

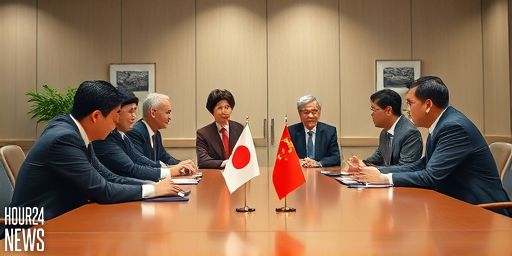

Regional Diplomacy and the Turkish Play

Beyond the nuclear question, regional diplomacy remains in flux. Turkish President Recep Tayyip Erdogan has signaled a proactive role in pursuing a regional reset, with early moves suggesting a desire to recalibrate security alignments and economic ties. While the United States’ stance toward Tehran remains a central pivot in any regional settlement, Ankara’s engagement hints at a broader, multi-layered approach to stability that could complicate Western-led efforts to manage Tehran’s behavior.

Analysts stress that any sustained improvement will require more than a symbolic snapback. A durable solution would need credible guarantees, a rebalanced security framework in the region, and tangible economic relief for Iran that also preserves international nonproliferation norms. In the near term, however, Iran faces a delicate balance: showing resilience against external pressure while avoiding a deeper economic collapse that could provoke broader social discontent or unpredictable political shifts.

Looking Ahead: The Regime’s Dilemma and Possible Scenarios

The coming months will test Tehran’s tolerance for sanctions, diplomacy, and domestic pressures. Possible paths include renewed talks on phased sanctions relief tied to verifiable compliance, gradual economic reforms aimed at stabilizing the currency and rebuilding investor confidence, or a further hardening of rhetoric if Western conditionality persists. Regardless of the path chosen, the underlying tension remains: the leadership must manage a population increasingly aware of rising prices, intermittent electricity and water supply, and a currency that undermines household security, all while navigating a charged geopolitical landscape.