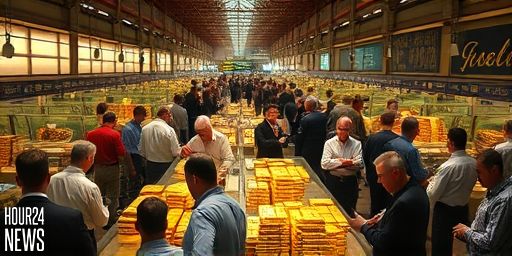

Overview of Recent Gold Price Trends

Gold prices saw a significant increase of 1.6% globally over the past week, reaching historic highs. This rise is largely attributed to growing anticipation regarding the Federal Reserve’s upcoming decision on interest rates. With this increase, gold has now experienced four consecutive weeks of gains, reflecting heightened interest in this precious metal as a safe-haven asset.

Factors Driving Gold Prices Upward

Several factors contribute to the rising gold prices. First, the uncertainty surrounding global economic conditions leads investors to gravitate towards gold. Historically, gold serves as a reliable hedge against inflation and currency fluctuations, making it an attractive investment during volatile times.

Moreover, expectations of a potential interest rate cut by the Federal Reserve have intensified demand for gold. Lower interest rates generally decrease the opportunity cost of holding non-yielding assets like gold. Investors believe that a decrease in rates might further weaken the U.S. dollar, enhancing gold’s appeal.

Market Reactions to Fed Speculation

As the markets eagerly await the Fed’s decision on interest rates, trader sentiment remains optimistic. A rate cut could boost gold prices even higher as investors rush to secure their holdings. This sentiment was evident in the trading volumes observed over the last week, with more investors entering the gold market.

In contrast, analysts caution that the gold market may experience sharp reactions depending on the Fed’s announcement. A decision to maintain current rates could lead to a temporary decline in gold prices, while a rate cut might propel them to new heights.

Global Economic Indicators and Gold

The interplay between gold prices and economic indicators is crucial. Recently, data points such as inflation rates, employment figures, and GDP growth have shown mixed signals. While some reports indicate robust economic performance, others highlight potential slowdowns, particularly in key markets like Europe and Asia.

This economic uncertainty creates an environment where gold can thrive. As inflation rises and economic growth becomes unpredictable, investors are more likely to allocate resources toward gold, further driving its value upwards.

Looking Ahead: What to Expect

As we move forward, all eyes will remain on the Federal Reserve’s meeting. Investors are keenly aware that the decisions made will impact not just gold prices but the broader financial markets. Analysts predict that if the Fed opts for a rate cut, gold could break through significant resistance levels, leading to unprecedented price heights.

In conclusion, the recent 1.6% increase in global gold prices is a clear reflection of market dynamics, driven by economic uncertainties and Fed speculations. As gold continues to show resilience in this tumultuous economic landscape, its role as a safe haven cannot be overstated.